As a CEO of an e-commerce company, I’m keenly aware of the immense opportunities and challenges tied to financial inclusion in developing economies.

Our company, Ling, is a successful ed-tech startup with a strong social-impact mission focused on language learning. Our app has been downloaded by more than five million people, all interested in learning a new language, including less widely spoken regional languages. We have a hugely engaged audience in India, and therefore a great opportunity for both ourselves and our users. But we have a problem.

Despite the rapid digital and economic growth witnessed over the last decade, a significant portion of India’s population remains outside the formal financial ecosystem.

At Ling, we’ve recognised India as one of our most engaged audiences for some time now. Analysing our user data reveals that traffic from India accounts for 23% of all blog visits— the largest share with approximately 144.6K visits monthly. Our app data also highlights India as the second-largest market for installations, trailing only Tier 1 regions. However, despite this high level of engagement, average install conversion rates are incredibly low at 0.004%.

What I find interesting is their specific interest in English and regional languages such as Telugu, Malayalam, and Bengali. This signals a strong, localised demand for language learning, presenting a substantial market opportunity for ecommerce businesses.

The financial accessibility gap in India

India has made impressive strides in improving financial inclusion; however, several barriers continue to prevent a large segment of the population from participating in the digital economy.

Unused bank accounts and limited access to credit cards

In order to play in the digital landscape, you generally need three things: a bank account, a mobile device, and a credit card. Having access to these can significantly impact the ability to make digital purchases or payments.

I find it interesting that 78% of adults in India have a bank account, but 35% of accounts are inactive. Of those that are active, spending power is low as the average account balance is Rs 130,000 (approximately $1,500 USD).

On top of that, access to credit remains low, as banks are hesitant to issue credit cards to individuals with limited credit histories, or with lower income levels. Without access to formal credit, these individuals are unable to make significant purchases online or establish a credit history necessary for upward financial mobility. In fact, only 4.62% of India’s 1.4 billion population have a credit card.

Insufficient internet penetration and digital literacy

Digital accessibility is crucial for both financial inclusion and ecommerce. As of recent statistics, internet penetration in India stands at around 52%, leaving a substantial portion of the population without reliable internet access.

This lack of connectivity is compounded by low digital literacy, especially in rural regions where smartphone penetration is less prevalent. Without the means to access the internet reliably, people cannot utilise online banking services or ecommerce platforms, further isolating them from potential economic opportunities.

The lack of internet access has resulted in only 38 percent of households in the country being digitally literate, but that’s not because they are unaware of the opportunity.

A staggering 94 per cent of consumers who are not using digital payments are aware of it but still don’t use it, as they face issues like lack of internet connectivity, limited knowledge, mistrust in online payments, and service-related problems.

Digital distrust

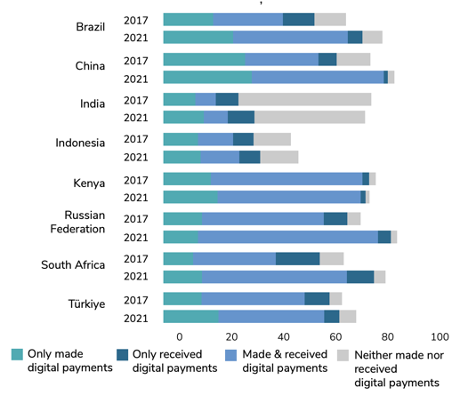

People are nervous about using the internet and giving away personal information. Digital scams are prevalent throughout the Indian subcontinent and a huge portion of the population is wary. Buying things online must seem like a trick to many and we can see that India falls far behind the developing world in adopting digital payments.

A growing share of account owners are making and receiving digital payments in developing economies.

Adults with an account (%), 2011 – 2021

Price localisation and currency conversion challenges

Many ecommerce platforms and international services lack localised pricing – our company has certainly been guilty of this. Often prices are presented in foreign currencies that don’t match the economic realities of consumers in developing regions. This dissuades individuals from making purchases as the additional currency conversion fees increase the perceived cost.

Additionally, international prices may simply be unaffordable, limiting the scope of online shopping.

Limited payment gateways and options

Another issue we are guilty of is not offering a range of payment options. This is critical to ensuring accessibility. If you want to buy something online but your payment gateway isn’t an option, how can you possibly buy the product or service? You can’t.

Many international businesses operating in India fail to support popular local payment methods, such as Unified Payments Interface (UPI), which has become the standard for digital transactions in India.

Without integrating local payment systems, businesses are limiting their reach to those who hold debit or credit cards, alienating a huge segment of consumers.

Strategies for expanding financial inclusion for developing nations

In my own company’s recognition of the above issues, we understand that to overcome these challenges and drive financial inclusion in India and other developing nations, actionable strategies must take place.

1. Localise pricing and product affordability

Offering localised pricing in Indian Rupees and adjusting prices to reflect India’s purchasing power would greatly enhance accessibility. For instance, Netflix and Amazon have introduced tiered pricing and mobile-only plans specifically for the Indian market, recognising the importance of cost adjustments in a price-sensitive economy. By localising prices, ecommerce platforms can make products and services more attractive and affordable to Indian consumers.

2. Partner with local payment providers

Collaboration with local payment providers like UPI and mobile wallet operators (e.g., Paytm, PhonePe) is crucial. Integrating these payment options on ecommerce platforms can provide seamless and accessible purchasing options, reducing the friction caused by requiring credit card information.

3. Leverage language localisation and AI translation tools

Language remains a significant barrier for many Indians who are more comfortable with regional languages. Localising websites and platforms into popular regional languages and incorporating AI-powered translation tools can help businesses bridge this gap. Ling has achieved this by providing learning resources in 44 native tongues including Hindi and Tamil, which makes language-based learning accessible and personalised for Indian users.

4. Offer low-bandwidth solutions

For an economy as vast as India’s, a mobile-first approach is essential. Ecommerce platforms can adapt their interfaces to cater to low-bandwidth users, allowing consumers with limited internet access to make purchases. This includes creating lightweight versions of apps and websites that can function effectively even in areas with poor connectivity.

By accommodating low-bandwidth regions, companies ensure that users in rural and underserved regions are not left out of the digital economy.

Unlocking developing nations’ economic potential through inclusion

By addressing these barriers, companies have an opportunity to both expand their market presence and contribute to economic growth, not just in India but across developing nations.

Initiatives to support financial inclusion, improve digital literacy, and enhance access to affordable products and services can make a significant impact. When businesses invest in localised strategies and tailored financial solutions, they contribute to a more inclusive digital economy that empowers millions and powers the bottom line.

Simon Bacher

Simon Bacher is the CEO and co-founder at Ling, a successful ed-tech startup focused on language learning. Under his leadership, Ling has surpassed 5 million downloads and actively aligns with social impact goals.